does td ameritrade report to irs

Under the Documents listing locate your T5. 3 Supplemental Summary Page A snapshot of the additional information that TD.

Schwab And Td Ameritrade To Take Big Revenue Cuts After Dropping Commissions Financial Planning

Does Ameritrade report to the IRS.

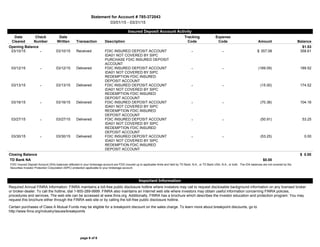

. Understanding Form 1040. If you have any questions please contact your Advisor or call TD Ameritrade Institutional at 800-431-3500. Anything else you want the.

Have you talked to a tax professional about this. To retrieve information from their server you will. Have you talked to a tax professional about this.

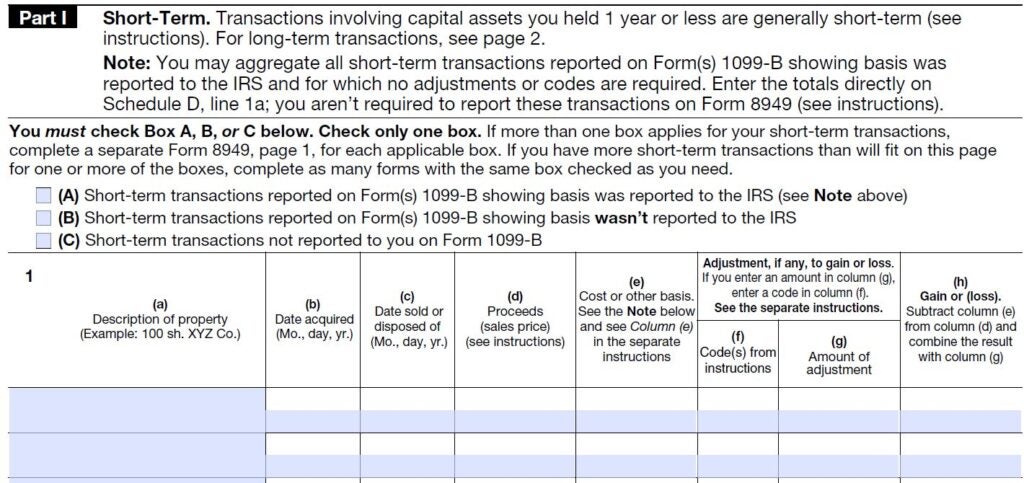

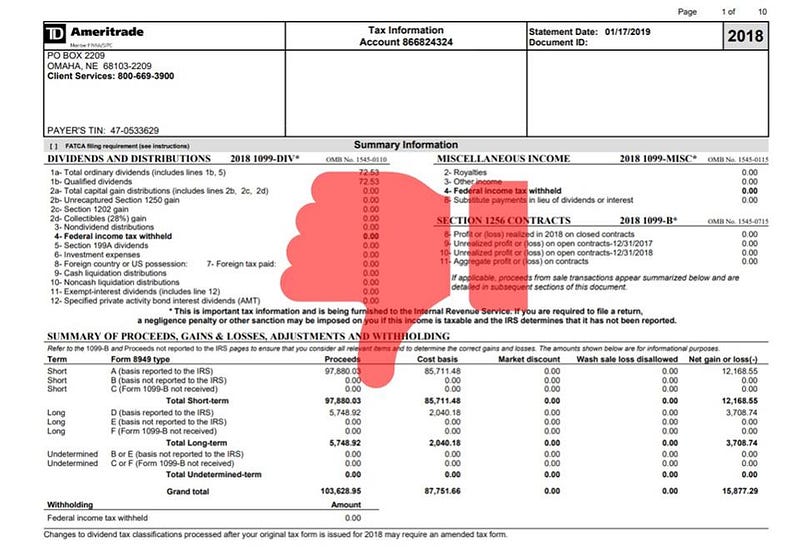

Like options-trading strategies the tax treatment of options trades is far from simple. Form 1099 OID - Original Issue Discount. Form 1099-B Proceeds from Broker and Barter Exchange Transactions is used to report the sale of stocks bonds mutual funds and other securities to the IRS.

Does Td Ameritrade Have Gold Ira Overview Does Td Ameritrade Have Gold Ira A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership. Steps to access your T5 through online banking. Individual Tax Return Form 1040 needs to be filed with the IRS by April 15 in most years.

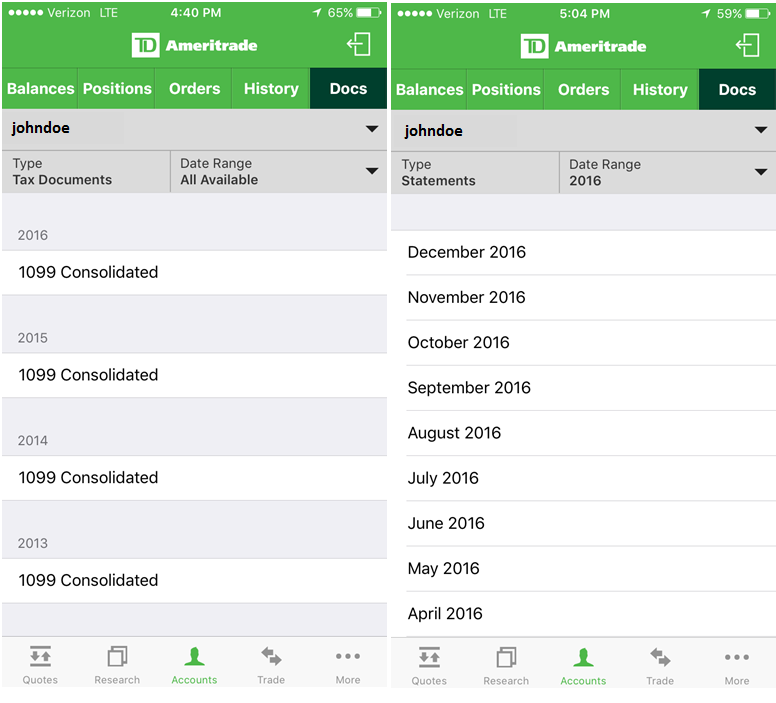

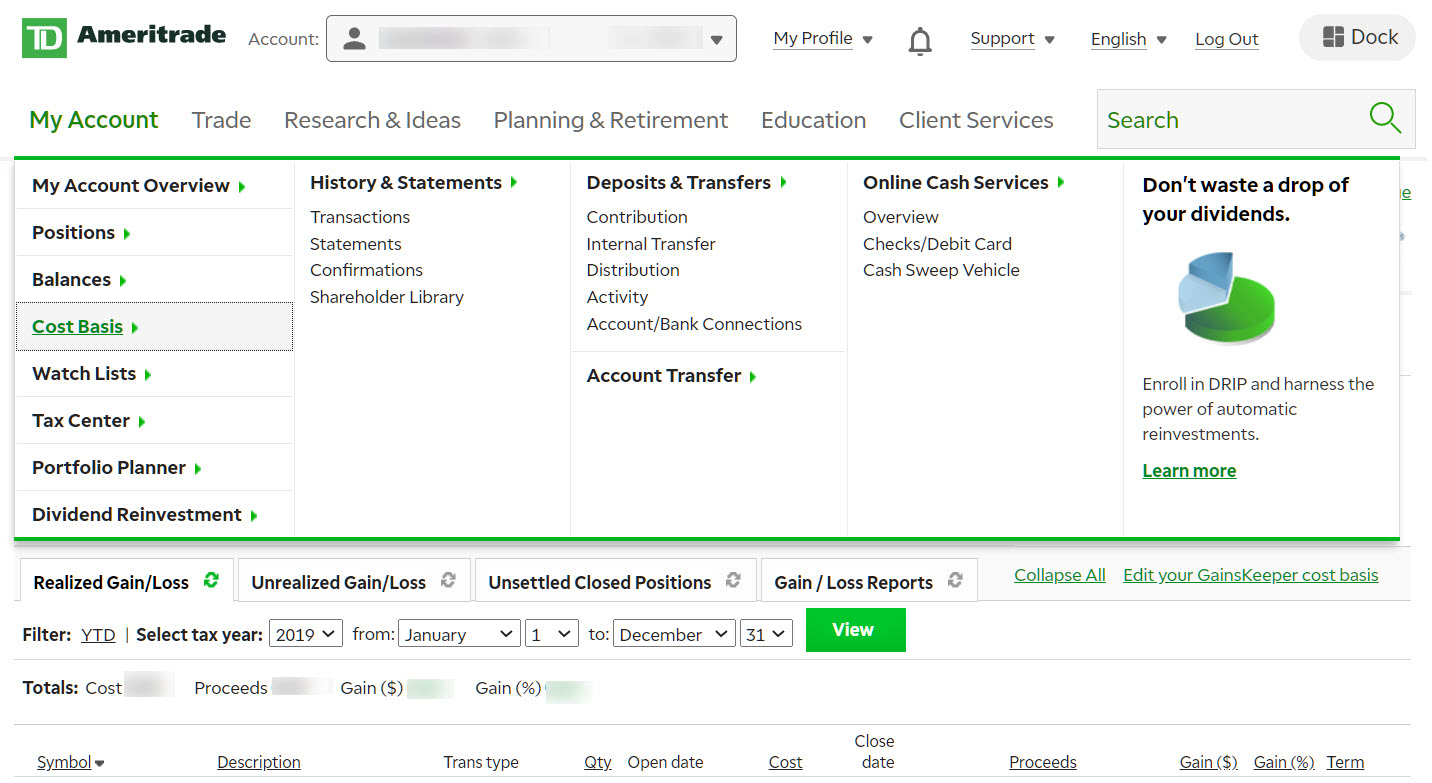

TD Ameritrade does not report this income to the IRS. Document ID Number What does TD Ameritrade report to IRS-----The most important part of our job is creating informational content. Under the My Accounts list in the left hand column click View e-Documents.

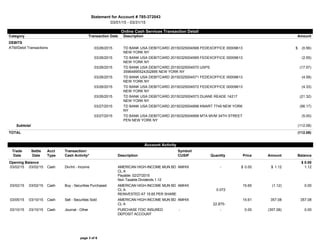

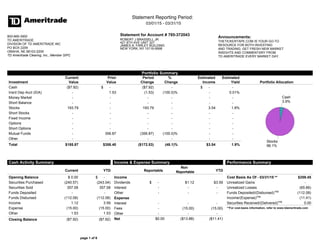

Since January 1 2013 brokers are required to report options trades to the IRS. My TD Ameritrade Tax Statement shows. TD Ameritrade hosts an OFX server from which your 1099-B realized gain and loss information may be retrieved by our program.

You pay tax on it if you profit income tax rate if short term capital gains. If you hold covered securities with tax-exempt original issue discount OID it will now be reported to the IRS on Form 1099-OID. TD Ameritrade was evaluated.

The custodian bank is charged with safeguarding your financial assets to report required information to the IRS eg 1099s etc and provide you statements of your holdings. The topic of this. We suggest you consult with a tax-planning professional with regard to your personal circumstances.

TD Ameritrade does not provide tax advice.

Td Ameritrade Review Top Ira Provider Good Financial Cents

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

How The Fed Cuts Impacted Charles Schwab Td Ameritrade E Trade Financial Planning

Td Ameritrade Review A Robust Investing Platform

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman

Mr Rjb Jr S Td Ameritrade Statements March 2015 06 18 2015

Robinhood Vanguard Td Ameritrade Affected By Stock Trading Outages

Td Ameritrade Review A Leading Online Stock Broker

Equities Hold Stocks Bonds Mutual Funds In A Self Directed Ira

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Ameritrade Solo 401k My Solo 401k Financial

Mr Rjb Jr S Td Ameritrade Statements March 2015 06 18 2015

Fill Free Fillable Td Ameritrade Pdf Forms

Td Ameritrade Review A Leading Online Stock Broker